A US appeals court on Friday temporarily halted President Joe Biden’s plan to cancel student debt for tens of millions of Americans. The decision came as part of a case brought by six Republican-led states.

The order came from the 8th US Circuit Court of Appeals after a judge dismissed a Republican-led lawsuit challenging the debt-forgiveness program. The states are seeking a preliminary injunction halting the policy.

A deadline of Monday has been given to the administration to respond to the request, and the states will have until Tuesday to reply to that response.

Also Read | Justice Amy Coney Barrett rejects appeal over Joe Biden student debt plan

On Thursday, US District Judge Henry Autrey in St. Louis ruled that while the six Republican-led states had raised “important and significant challenges to the debt relief plan,” the lawsuit was dismissed on grounds that it lacked the necessary legal standing required to pursue the case.

Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina said Biden’s plan threatened the states’ future tax revenues and money.

“We are pleased the temporary stay has been granted,” Nebraska Attorney General Doug Peterson said in a statement, according to the Washington Post. “It’s very important that the legal issues involving presidential power be analyzed by the court before transferring over $400 billion in debt to American taxpayers.”

About 22 million people have already applied for debt relief since the application opened on October 14.

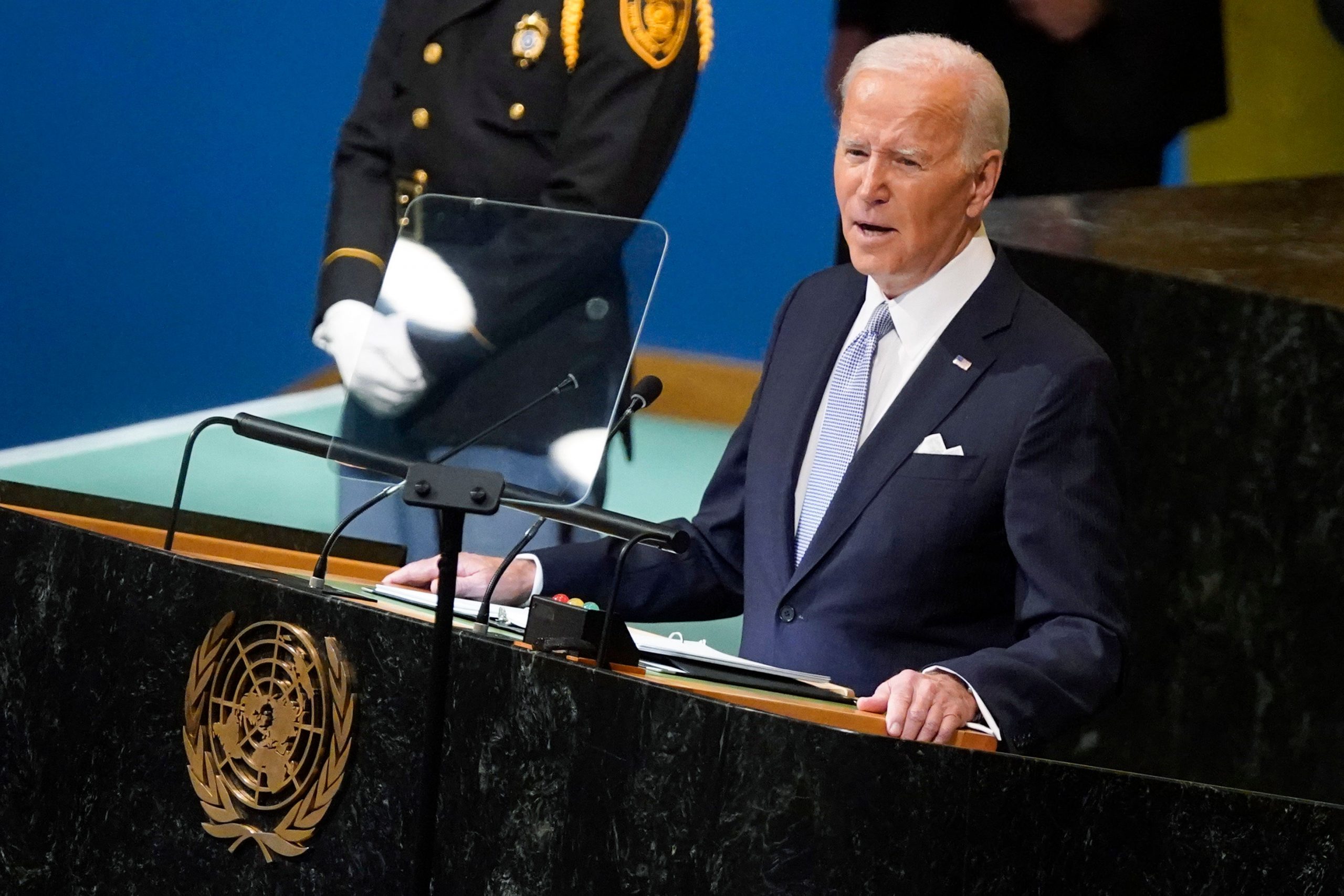

Speaking at Delaware State University, Biden spoke out about the first-week statistics since the application was beta-launched last Friday.

Also Read | Joe Biden administration to expand round-the-clock mental health care

Biden also slammed Republicans who have criticized his relief program, saying “their outrage is wrong and it’s hypocritical.” He added, “I don’t want to hear it from MAGA Republican officials” who had millions of debt and pandemic relief loans forgiven.

Biden’s student loan forgiveness program, first announced in August, includes up to $10,000 in debt cancellation for borrowers who earn less than $125,000 a year. Couples who file taxes jointly and earn less than $250,000 annually can also avail the debt cancellation.

Pell Grant recipients would be eligible for an additional $10,000 in debt relief. These recipients make up the majority of borrowers.

In the application, borrowers have to “certify under penalty of perjury” stating that the information they input is correct. In case of any false information is provided, borrowers could face potential legal repercussions.

The White House said that borrowers must apply before mid-November if they wish to see their loans canceled by the time the pause on student loan payments lifts on Jan. 1, 2023. This pause has been in place since the beginning of the pandemic. The application for debt relief will close on Dec. 31, 2022.