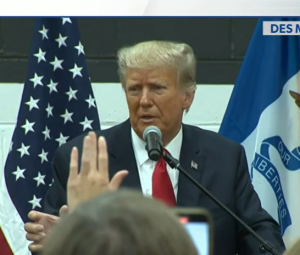

The accounting firm that prepared former President Donald Trump‘s annual financial statements says the documents, which were used to secure lucrative loans and burnish Trump’s image as a wealthy businessman, “should no longer be relied upon” after New York‘s attorney general said they routinely misrepresented asset values.

Also read: Super Bowl 2022: Eminem takes a knee during Halftime Show

Mazars USA LLP urged the Trump Organization’s counsel in a letter dated February 9 to tell anyone who had obtained the records not to use them when analysing the company’s and ex-financial president’s health. The firm also announced that it was ending its relationship with Trump, its most high-profile customer.

Mazars’ letter was made public in a court filing on Monday, just weeks after New York Attorney General Letitia James announced that her civil investigation had discovered evidence that Trump and his company used “fraudulent or misleading” valuations of their golf clubs, skyscrapers, and other properties to obtain loans and tax benefits.

“While we have not concluded that the various financial statements, as a whole, contain material discrepancies, based upon the totality of the circumstances, we believe our advice to you to no longer rely upon those financial statements is appropriate,” Mazars General Counsel William J. Kelly wrote to his Trump Organization counterpart, Alan Garten.

Also read: Hillary Clinton takes a dig at Donald Trump with ‘but her emails’ cap

Because of a conflict of interest, Kelly notified Garten that Mazars could no longer work with Trump and advised him to find another tax preparer. Kelly stated that other Trump-related tax returns, including the former president’s and first lady’s, were still pending.

The Trump Organization expressed disappointment in Mazars’ decision to break ways in a statement, but viewed Kelly’s letter as a positive because the accounting firm identified no substantial inconsistencies in Trump’s financial records.

The letter “confirms that after conducting a subsequent review of all prior statements of financial condition, Mazars’ work was performed in accordance with all applicable accounting standards and principles and that such statements of financial condition do not contain any material discrepancies,” the Trump Organization said. “This confirmation effectively renders the investigations by the DA and AG moot.”

Kelly said Mazars performed its work on Trump’s financial statements “in accordance with professional standards” but that it could no longer stand by the documents in light of James’ findings and its own investigation. Kelly said Mazars’ conclusions applied to Trump’s 2011-2020 financial statements. Another firm handled Trump’s 2021 financial statement.

Also read: Virginia Deputy Attorney General resigns over Facebook posts on Jan 6 riots

A copy of Kelly’s letter was included in a court filing by James’ office, which is seeking to enforce a subpoena requiring Trump and his two eldest children, Donald Jr. and Ivanka, to appear under oath. Arthur Engoron, a state court judge, will hear arguments in the subpoena issue on Thursday.

James, a Democrat, said Monday that given the evidence, “there should be no doubt that this is a lawful investigation and that we have legitimate reason” to question Trump, a Republican, and his children, both of whom have been Trump Organization executives.

Trump’s lawyers have argued that any testimony they give could be used against them in a separate criminal investigation overseen by the Manhattan district attorney’s office, which resulted in tax fraud charges against the Trump Organization and Allen Weisselberg, the company’s longtime chief financial officer, last year.

Trump has given his Statement of Financial Condition — a yearly snapshot of his holdings — to banks to secure hundreds of millions of dollars worth of loans on properties such as a Wall Street office building and a Florida golf course, and to financial magazines to justify his place among the world’s billionaires.

In a court filing last month, James’ office detailed several instances in which Trump misstated the value of assets on financial statements given to banks.

Deutsche Bank accepted Trump’s financial statements without objection in a deal for $300 million in loans for three of his properties and, in internal memoranda, emphasized Trump’s reported financial strength as a factor in lending to him, James’ office said.

Also read: Donald Trump clogged toilets with secret presidential documents: Report

Another bank said it received financial statements in 2014 stating Trump had a net worth of $5.8 billion and liquidity of $302 million. A bank official involved in that deal told James’ office that if he were aware of misstatements on Trump’s statement of financial condition, he would have killed the deal.

James office said its investigation started after Trump’s former personal lawyer, Michael Cohen, told Congress in 2019 that Trump had a history of misrepresenting the value of assets to gain favorable loan terms and tax benefits.

The House Committee on Oversight and Reform received copies of three of Trump’s financial statements from Cohen. Trump allegedly made the statements to Deutsche Bank in order to obtain a loan to purchase the NFL’s Buffalo Bills and to Forbes magazine in order to legitimise his claim to a spot on the magazine’s list of the world’s wealthiest people, according to Cohen.

Cohen was sentenced to federal prison in 2018 after pleading guilty to tax crimes, lying to Congress, and campaign finance violations, including his involvement in organising payments to two women to keep them quiet about Trump’s alleged relationships.

Trump’s lawyers have portrayed Cohen as having a vendetta against Trump and said in a recent court filing that it “stretches all credibility to believe that” James’ office put “any legitimate stock” in his testimony.

James’ office responded Monday that not only did it rely on Cohen’s testimony, but that his testimony is “vindicated by the evidence obtained to date and Mazars’s notification that those statements should not be relied upon.”

(with inputs from AP)