After weeks of negotiating to resurrect the heart of their election-year agenda, Senate Democrats pushed a spending measure that would aim to address climate change, the high cost of prescription pharmaceuticals, and reduce the deficit by around $300 billion. This bill, if passed, will be known as the Inflation Reduction Act.

Senators voted on amendments to Democrats’ massive spending bill, which addresses health care, climate change, and taxation, late Saturday night and early Sunday morning.

Also read: Senate Democrats push Biden’s health, climate bill, House to vote next

Because none of the 50 Republican senators voted for the bill, it was enacted through the budget reconciliation process, which required all 50 Democrats and one tie-breaking vote from Vice President Kamala Harris. It also limits the bill’s provisions to those that directly affect federal spending and revenue.

Despite a few modifications from the Senate parliamentarian, Majority Leader Chuck Schumer, D-N.Y., said Saturday that the package overall represents a legislative success for Democrats.

“It’s been a long, tough, winding road,” Schumer stated before the final vote on Sunday.

Also read: US House Speaker Nancy Pelosi looks to ‘swiftly’ pass climate and healthcare spending bill

Democrats have contended that the bill, dubbed the Inflation Reduction Act, will address voters’ primary economic issue. Republicans claim that the new expenditure will increase inflation. However, the nonpartisan Congressional Budget Office estimates that the law will have a “negligible” influence on inflation in 2022 and 2023.

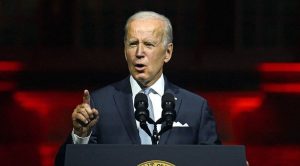

Overall, the plan is a far smaller version of what many Democrats, including President Joe Biden, had originally requested.

“This bill is far from perfect. It’s a compromise. But it’s often how progress is made,” last month, Biden stated at the White House. “My message to Congress is this: This is the strongest bill you can pass.”

Following Senate passage, the House aims to take up the bill at the end of the week and submit it to President Biden for signature.

Also read: What is vote-a-rama?

Here’s a look at what did and didn’t make it into the Democrats’ measure.

Combating Climate Change

Over $300 billion would indeed be invested in energy and climate reform, making it the greatest federal clean energy investment in US history.

Many environmental and climate activists favour the plan, but it falls short of the $555 billion requested by Democrats.

This section of the plan addresses transportation and electricity generation, and it contains $60 billion in funding for the expansion of renewable energy infrastructure in manufacturing, such as solar panels and wind turbines.

It also offers a number of tax breaks for people, such as those for electric vehicles and making dwellings more energy efficient.

Also read: What remains in and what’s out of Democrats’ Inflation Reduction Act package: Explained

According to Democrats, the plan will reduce greenhouse gas emissions by 40% by the end of the decade, compared to 2005 levels, falling short of Biden’s original goal of 50%.

“It puts us within a close enough distance that further executive action, state and local government efforts and private sector leadership could plausibly get us across the finish line by 2030,” Jesse Jenkins of Princeton University, who directs the REPEAT Project, which examines the impact of government climate policies, agreed.

Prescription medicine cost reduction

In terms of health reform, the plan focuses on making prescription pharmaceuticals more cheap — but with some caveats.

The law contains a historic provision that empowers the federal health secretary to negotiate the prices of select pricey pharmaceuticals for Medicare each year.

However, this will not affect every prescription drug or every patient, and it will not take effect immediately. The discussions will go into effect for 10 Medicare medications in 2026, expanding to 20 drugs in 2029.

Also read: Joe Biden signs anti-fraud pandemic bills while still in isolation

The portion of the bill that attempted to cap the price of insulin at $35 per month — a drug that is extremely expensive in the United States in comparison to other countries — was reigned out of order by the Senate parliamentarian, who ruled that the cap could apply on Medicare, a government programme, but not on private insurance. As a result, Democrats split the bill between Medicare and private insurance, but Republicans ultimately defeated the private insurance bill.

The parliamentarian also determined that a provision in the plan requiring drug firms to offer rebates if prescription prices beat inflation violated budget reconciliation rules; she stated that it may apply to Medicare patients but not to those with private coverage.

The bill, which goes into effect in 2025, caps out-of-pocket prescription drug expenditures for Medicare recipients at $2,000 per year.

The Affordable Care Act also includes a three-year extension of healthcare subsidies, which were originally included in a pandemic relief bill last year and are estimated by the government to have kept premium rates at $10 per month or less for the vast majority of people covered through the health insurance subsidies exchange.

Also read: Nancy Pelosi’s flight to Taiwan becomes most tracked flight in the world: Report

This helps millions of Americans avoid unexpected increases in their health-care bills.

Taxation reform

The legislation imposes a 15% minimum tax on firms with annual revenues of $1 billion or more, raising more than $300 billion in revenue.

However, one provision that was deleted was one that tightened the carried interest tax loophole. Arizona Senator Kyrsten Sinema promised to sign the package if this provision, which would have changed how private equity income is taxed, was removed. Democrats estimated that it would have generated $14 billion in income.

Instead, a 1% excise tax on stock buybacks was imposed, which may generate about five times the income as the carried interest legislation. However, it would not go into effect until next year, heightening expectations of a surge of buybacks by some corporations before 2023.

Also read: Jackie Warloski death: Biden recalls Congresswoman’s achievements

The Child Tax Credit is extended, but it is not included in the measure due to opposition from West Virginia Sen. Joe Manchin. Manchin stated last year that the expense of extending the credit was prohibitively expensive, but progressives, particularly Vermont Senator Bernie Sanders, have continued to advocate for its inclusion in the package.

Sanders intended to include it as an amendment to the measure during the all-night voting session, despite the fact that he lacks the necessary votes to pass it.