In an effort to survive the market and political unrest plaguing the nation, British Prime Minister Liz Truss dismissed her finance minister Kwasi Kwarteng on Friday, just before she is slated to abandon portions of their economic programme.

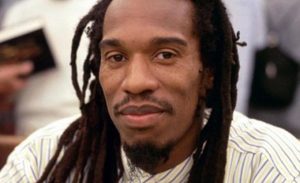

After travelling from IMF meetings in Washington to London overnight, Kwarteng said he quit at Truss’s request. Only having been in office for 37 days, Truss will hold a press conference later on Friday, according to Downing Street.

“You have asked me to stand aside as your Chancellor. I have accepted,” said in his resignation letter to Truss, which Kwarteng posted on Twitter.

Also Read| UK Prime Minister Liz Truss makes U-turn on proposed tax cuts

Prior to Truss’s remark, British government bonds increased their partial recovery, which had already begun since her government began looking for methods to balance the books after her unfunded tax cuts destroyed UK asset values and garnered international criticism.

Also Read| Why has Decathlon reversed its name to Nolhtaced in Belgium?

The shortest-serving chancellor in British history since 1970, Kwarteng, will be replaced by the fourth finance minister in as many months as millions of Britons struggle with growing living expenses. The shortest-serving British finance minister passed away.

On September 23, Kwarteng unveiled a new fiscal strategy, fulfilling Truss’s goal for major tax cuts and regulatory reform in an effort to shock the economy out of years of slow development.

However, the market’s reaction was so fierce that the Bank of England was forced to step in to stop pension funds from becoming embroiled in the confusion as borrowing and mortgage costs skyrocketed.

Since then, the pair has come under increasing pressure to change course as surveys revealed that support for their Conservative Party has plummeted, leading colleagues to question openly whether they need to be replaced.

Also Read| Joe Biden pays 4 times more for tacos during Los Angeles visit

Their proposal to maintain corporation tax rates at 19% is one policy that is anticipated to be reversed. That was a crucial component of their proposal because Sunak had suggested raising it to 25% while serving as finance minister under Boris Johnson, who succeeded Truss. By 2026–2027, this might save 18.7 billion pounds.