British Prime Minister Liz Truss has rolled back parts of a contentious economic package shortly after firing her finance minister Kwasi Kwarteng in a bid to stay in power.

Despite initial promises that there would be no changes to the proposed economic plan, the 37-day-old PM has made a U-turn under intense pressure from within the Conservative Party and the plummeting value of the pound.

In a news conference on October 14, Truss said that she would allow a rise in a key business tax starting next year in an effort to raise 18 billion pounds. At the press briefing Truss said, “We need to act now to reassure the markets of our fiscal discipline.”

Also Read | UK Prime Minister Liz Truss makes U-turn on proposed tax cuts

The United Kingdom has traditionally had a reputation for sound economic management and financial stability, but Truss’ announcement led to severe backlash from recession-worried investors.

So harsh was the market reaction, that the Bank of England had to step in to prevent pension funds from being hit. As a result of the PM’s announcement, borrowing and mortgage costs surged.

The reversal of the tax cuts at this time means that Truss is desperate to retain control of the Conservative Party as short-lived solidarity has turned to infighting.

The PM now has to find a way to cut public spending and raise taxes in a way that will appeal to investors, the general public and MPs in the House of Commons. This is likely to be made all the more difficult considering the Tories have spent the last few years gutting funding for public services.

“If you can’t get your budget through parliament you can’t govern. This isn’t about u-turns, it’s about proper governance. It’s self-evident,” wrote senior Labour Party lawmaker Chris Bryant on Twitter, adding the hastag #generalelectionnow.

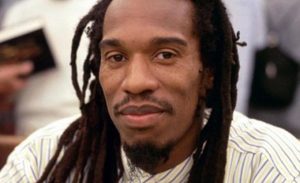

Following the sacking of the previous finance minister Kwasi Kwarteng, a previous foreign and health secretary Jeremy Hunt, has been appointed to the office.