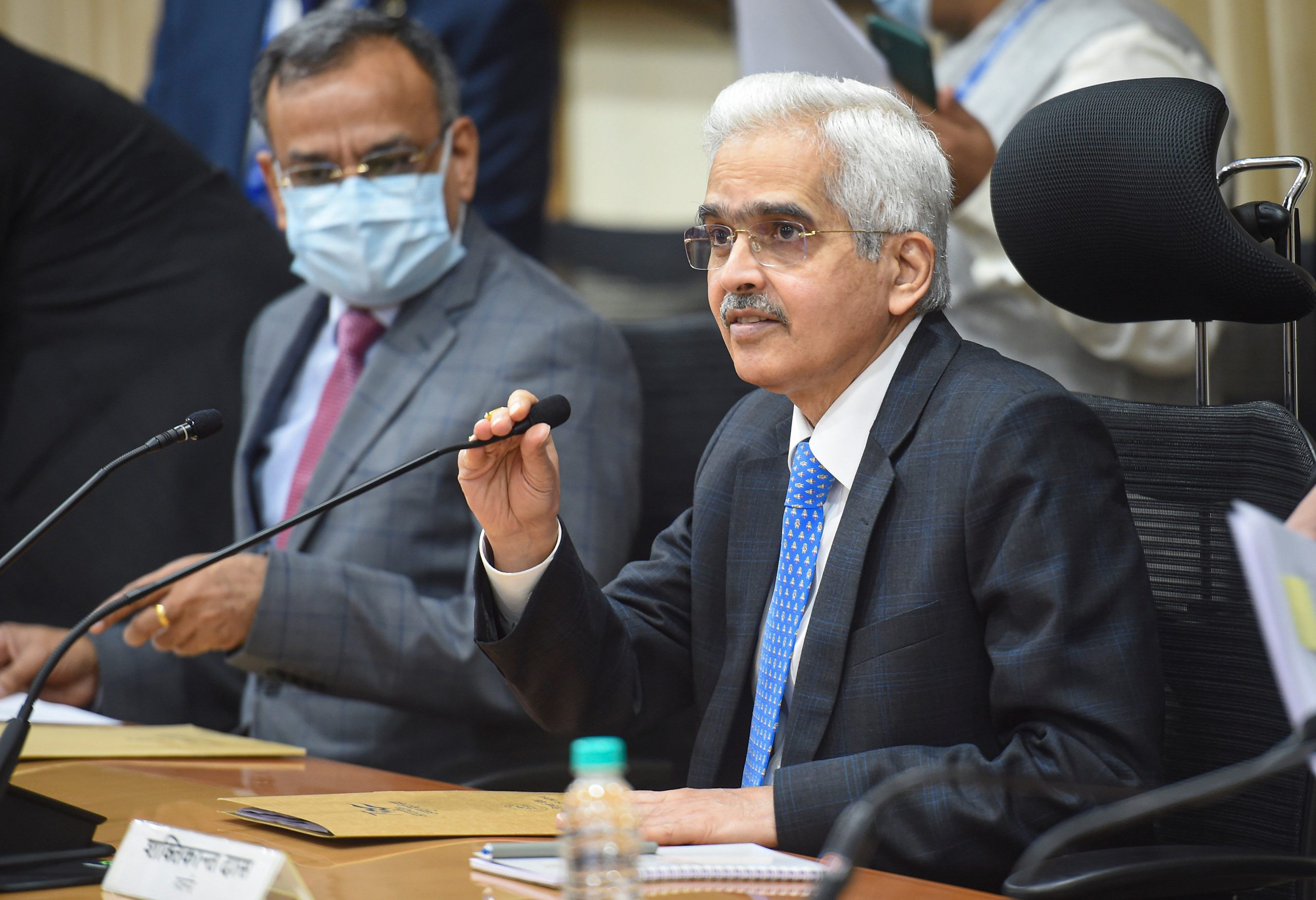

Reserve Bank of India (RBI) Governor Shaktikanta Das said the inflation has peaked and is expected to moderate to around 5% by the April-June quarter of the next year.

Inflation has remained above RBI’s 2% to 6% tolerance band for several months, with consumer inflation at 6.71% in July from 7.01% in June. It was the first time since April 2022 that retail inflation had fallen below the 7% level.

Also Read | GST collection rises 28% to Rs 1.43 lakh crore in August

“Inflation has become a global phenomenon. The globalization of inflation has happened now,” Das said in an interview with Zee Business on September 2.

“Considering the global situation, we can say that inflation reached its peak in India in April, but will now gradually come down,” added Das.

The RBI Governor said there will be a few ups and downs in the coming months, but the trajectory will be mostly downward in the future. There are various reasons why inflation will be on a downward trajectory such as falling crude oil prices. Commodity and food prices have also fallen.

Also Read | India’s manufacturing PMI edges down to 56.2 in August from 56.4 in July

However, he refused to comment on initiatives that could be announced after the upcoming policy meeting. He said it would be difficult and also wrong to give any forward guidance in terms of monetary policy as the situation keeps changing.

Das stated that tackling inflation is the central bank’s top priority and the RBI will try to minimize its impact on growth. The domestic economic activities, including high-frequency indicators, are resilient. The RBI is also studying why the GDP growth in April-June 2022 quarter was lower than what it had projected, he said.

Also Read | India’s GDP Quarter 1 numbers: Sector-wise performance

“We have identified some areas and will address them accordingly in the upcoming monetary policy after thorough study,” he explained.

The first quarter of GDP growth will be discussed at the next Monetary Policy Committee’s (MPC) meeting. The global slowdown and global inflation are impacting India, the Governor said.

Also Read | RBI lifts restrictions on American Express on onboarding new customers

India’s economy grew at 13.5% in the April-June quarter of the ongoing financial year, according to data released by the National Statistical Office on August 31. The growth rate was significantly lower than the 16.2% forecast by the RBI MPC.

Das said the RBI constantly monitors the credit growth of all banks. The RBI cautions banks when they see excessive credit growth in an area. “Our digital rules are well received by all segments of lenders. The RBI’s new digital rules are consumer-centric, focus is on transparency,” he added.

Also Read | Amazon loses bid to overturn union election win in Staten Island warehouse

The central bank’s digital rules focus on risk assessment, management, and mitigation.

Das also said India’s high foreign exchange (forex) reserves are a strong buffer for the economy. Forex reserves are keeping the rupee stable.

Also Read | Adani Enterprises to replace Shree Cement on NSE’s Nifty 50 index

The RBI’s Monetary Policy Committee raised the key repo rate by 50 basis points to 5.4% in early August. It was the third straight hike after a 50 percentage point rise in June and 40-point hike in May. The next meeting of the MPC is scheduled for September 28-30, 2022.