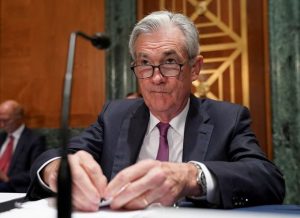

Oil prices dropped as investors remained worried about a slowdown in demand following the Federal Reserve‘s three-quarters-point hike in interest rates. Oil prices were already trending down before the meeting. The rate hike sank them further.

Brent crude futures fell $0.71, or 0.78%, to $89.7 a barrel. West Texas Intermediate crude in the United States declined $0.93, or 1.11%, to $82.951 per barrel.

Also Read | US Federal Reserve hikes interest rates by 75 basis points to fight surging inflation

Crude oil prices have been falling since the morning after the US Energy Information Administration reported a crude oil inventory build of 1.1 million barrels for the week to September 16.

The prior week’s inventory build was predicted by the EIA to be 8.8 million barrels. The American Petroleum Institute anticipated a crude oil inventory build of slightly over 1 million barrels a day before this week’s EIA data.

Also Read | Gold prices fall after US Fed interest rate hike

The EIA estimated last week’s output at 9.5 million BPD and recorded a build of 1.6 million barrels in gasoline stockpiles. This compares to a 1.8 million barrel inventory draw the previous week and a production rate of 9.5 million barrels per day.

The EIA anticipated a 1.2 million barrel inventory rise in middle distillates for the week ended September 16, compared to a 4.2 million barrel build the previous week. Last week, middle distillate output averaged 5.2 million barrels per day, up from 5 million barrels per day the prior week.

Also Read | Treasury yields rise as US Fed raises interest rates by 75 basis points

While gasoline prices have fallen during the last couple of months, it is still around $0.50 per gallon more expensive for American drivers than it was this time last year.

Prices have fallen in the last two days as the market braced for another rate rise by the Federal Reserve.

Also Read | Bitcoin, Ethereum falls over 1% as US Fed hikes key interest rates

Higher rates usually result in a stronger dollar, which in turn lowers the price of crude oil, with oil more expensive for buyers holding foreign currencies. The dollar reached a 20-year high earlier on Wednesday.