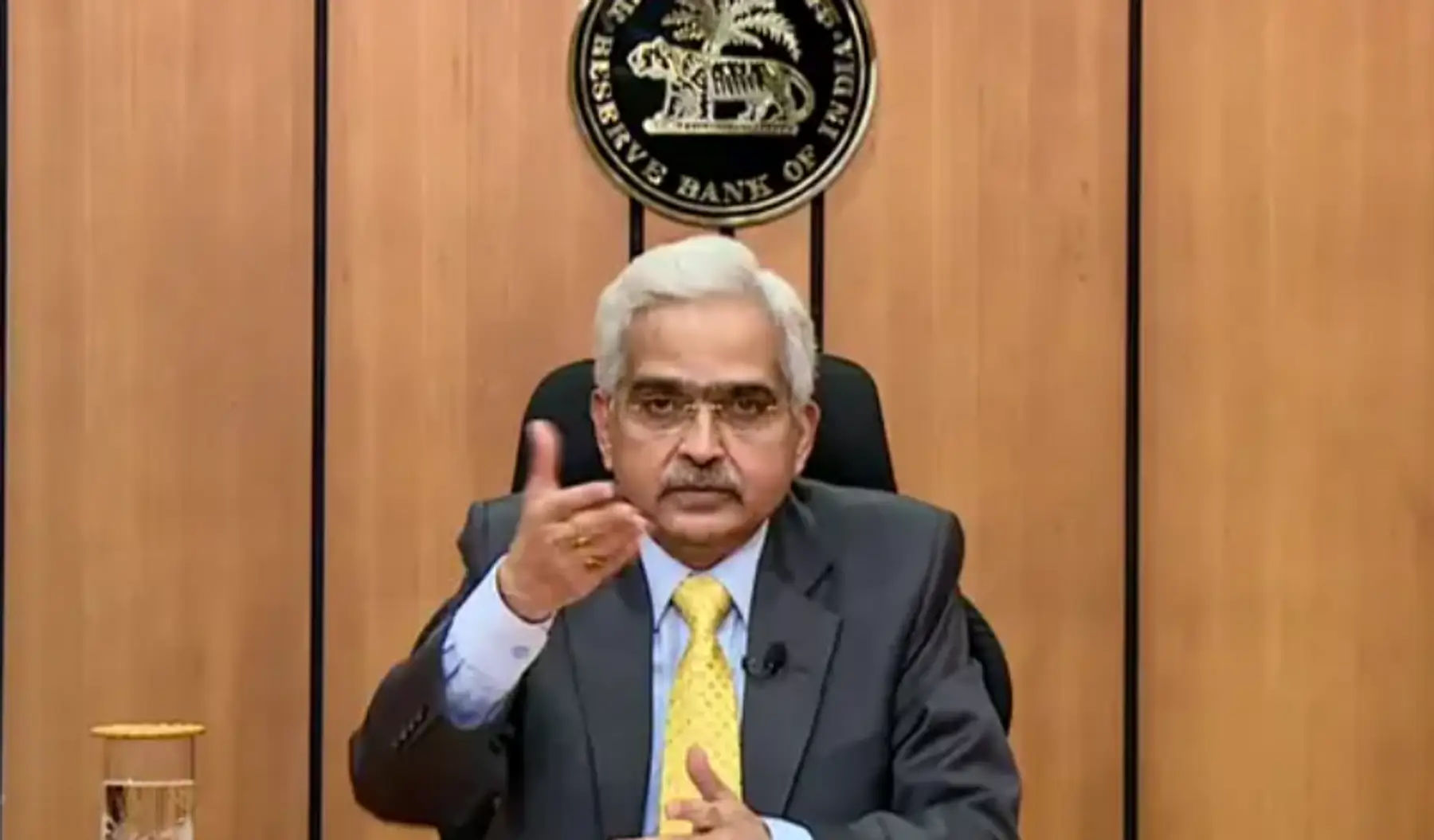

The decision of the six-member Monetary Policy Committee (MPC) led by RBI Governor Shaktikanta Das was announced on Friday. The Reserve Bank of India (RBI) raised the repo rate for the fourth time this cycle to contain persistently above-target retail inflation.

Key highlights from RBI Governer’s speech:

1. The reserve bank of India hiked the repo rate by 50 basis points to 5.9%. In the last 5 months, Repo Rate saw an increase of 190 bps. The Monetary Policy Committee (MPC) decided to remain focused on ‘withdrawal of accommodation’.

Also Read | RBI hikes repo rate by 50 basis points to 5.90%

2. The standing deposit facility (SDF) rate and the marginal standing facility (MSF) rate were also raised to 5.65% and 6.15%, respectively.

3. India’s real GDP Growth for FY23 is now projected at 7%. The GDP growth is seen at 6.3% in Q2 FY23 and 4.6% in Q3 FY23 and 4.6% in Q4 FY23.

Also Read | Why RBI would be pushed to hike interest rates

4. Inflation is hovering around 7% and the Governor expect it to remain elevated at around 6% in the second half of the financial year. CPI inflation is seen at 7.1% in Q2 FY23, 6.5% in Q3 FY23 and 5.8% in Q4 FY23. CPI inflation is seen moderating to 5% in Q1 FY24.

5. The rupee has fallen 7.4% against the US dollar from April 2022. The currency has depreciated in an orderly manner. The Indian rupee has fared much better than several other currencies. The rupee is a freely floating currency. RBI doesn’t have a fixed exchange rate in mind. The central bank intervenes to adjust volatility in the market. Intervention in the FX market based on evolving situation, and the forward guidance may destabilize capital markets, Das said.

Also Read | Why interest rates are being hiked globally?

6. India’s foreign exchange reserves stand at $537.5 billion, RBI Governor Shaktikanta Das said. About 67% of the decline in India’s forex reserves in FY23 is due to valuation changes resulting from dollar appreciation. There was an accretion of $4.6 billion to the dollar reserves during the current financial year. Interventions in the forex market are based on an assessment of prevailing market conditions.

7. The Indian basket of crude oil prices stood at $104/barrel in the first half of FY23, Das says. The MPC is assuming Brent crude at $100 per barrel in the second half of FY23, he says.

Also Read | Where to invest during high inflation?

8. The monetary policy committee decided that the 28-day VRRR be merged with the 14-day VRRR auction and only the 14-day VRRR auction will be conducted.

9. The Reserve Bank of India proposes to extend rules that apply online payment aggregators to offline payment aggregators as well, RBI Governor Shaktikanta Das says.

Also Read | India does not have problems like Sri Lanka, Pakistan: Raghuram Rajan

10. High-frequency data for the second quarter indicates that economic activity remains resilient, and private consumption has been holding up. Rural demand is also gaining gradually, investment demand picking up, agriculture sector remains resilient said, Shaktikanta Das.