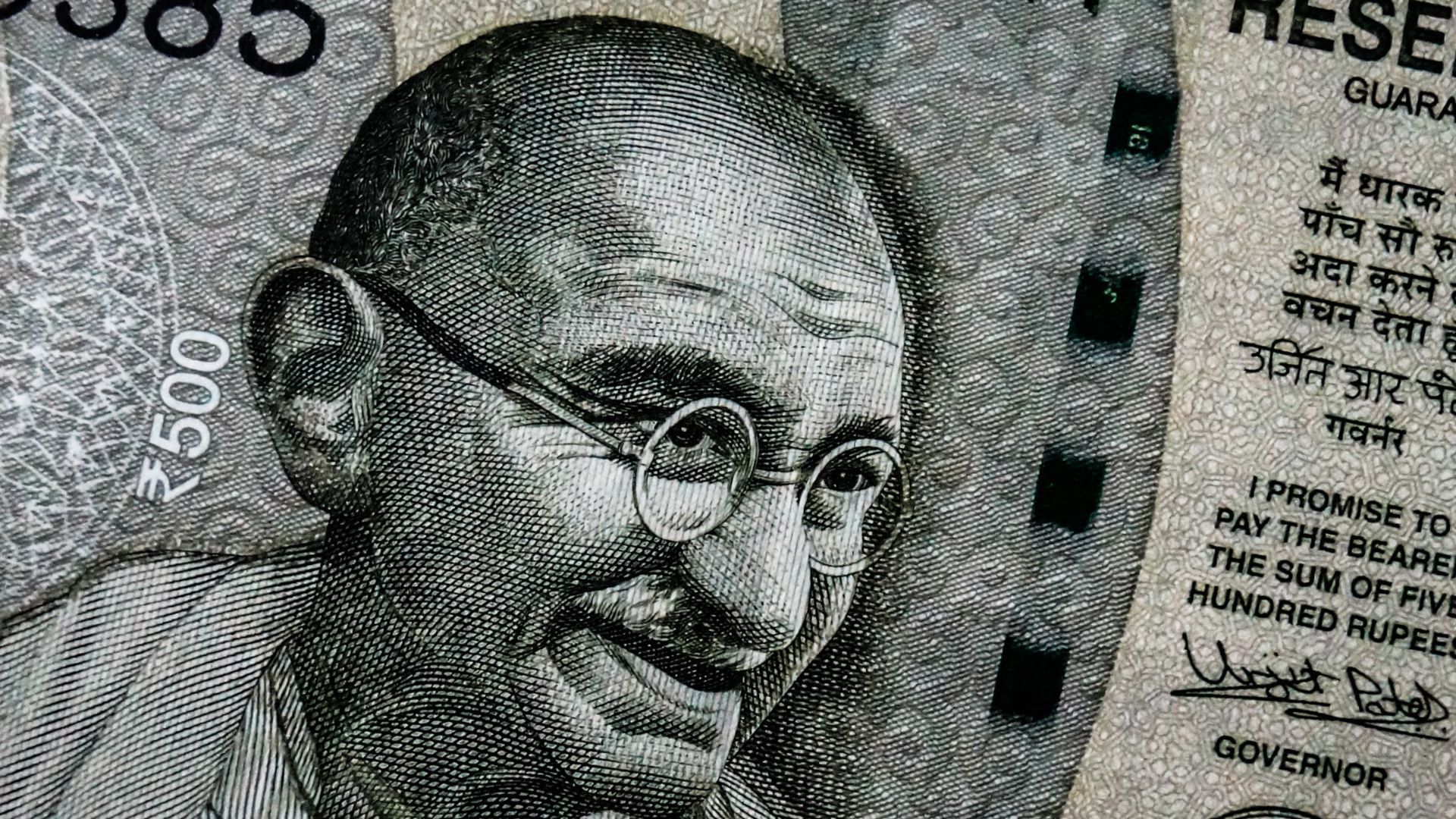

The rupee slipped by 31 paise to settle at 82.78 against the US dollar on Monday impacted due to stronger US dollar in the overseas markets.

The local currency began weaker at 82.35 against the US dollar at the interbank foreign exchange market. It recorded a high-low of 82.32 and 82.80 on Monday. It finally closed 15 paise lower at 82.78 against the US dollar.

Also Read: Closing Bell: Sensex jumps 786 points, Nifty up 224 points

The Indian rupee depreciated on Monday amid strength in the US dollar. However, positive domestic equities and weak crude oil prices cushioned the downside, said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

Moreover, inflows by foreign investors supported the rupee at lower levels.

“We expect the rupee to trade with a negative bias amid strong US dollar amid increasing odds of an aggressive rate hike by the Fed on Wednesday. Some recovery in crude oil prices may also weigh on Rupee,” Choudhary added.

Also Read: Gold, silver and other metal prices on Monday, October 31, 2022

Traders may remain cautious ahead of manufacturing PMI and trade deficit data, which is expected to be released on Tuesday, Choudhary said, adding, “We expect USD-INR spot price to trade in the range of 81.80 and 83.30 in the next couple of sessions.”

The rupee fell 15 paise to settle at 82.48 against the dollar in the previous session on Friday.

Also Read: Binance’s CZ confirms $500 million investment in Elon Musk’s Twitter deal

The dollar index, which measures the US Dollar’s strength against a basket of six currencies, rose by 0.28% to 111.05.

Concurrently, Brent crude futures, the international oil benchmark fell 0.93% to $94.88 per barrel.

The BSE Sensex rose 786.01 points or 1.31% to end at 60,746.59 on the domestic stock market, Similarly, the NSE Nifty gained 225.40 points or 1.27% to settle at 18,012.20.

Also Read: Twitter delisted from New York Stock Exchange after Elon Musk acquisition

According to exchange data, foreign Institutional Investors (FIIs) were net buyers in the equity markets as they purchased shares worth Rs 1,568.75 crore, while Domestic Institutional Investors sold shares worth Rs 613.37 crore on Thursday, October 28, as per data available on NSE.