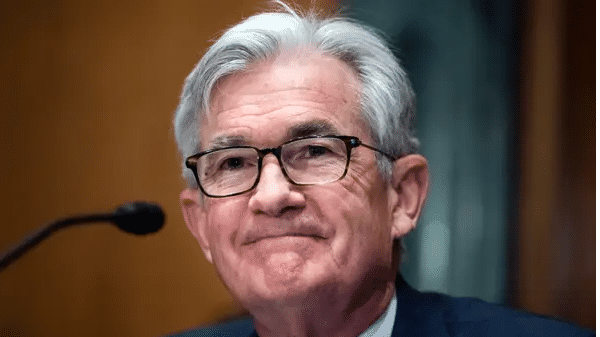

Fed Chair Jerome Powell began his press conference by highlighting the possibility of another 0.75 percentage point rate hike at the next meeting.

“Another unusually large increase could be appropriate” at the September meeting, he said.

On Wednesday, the Fed agreed to its second consecutive rate hike of that scale. However, the slowing economy has raised concerns about the Fed’s future policy direction.

Also Read | Impact of Fed rates on US stocks and bond markets

Nothing was put in stone, according to Mr Powell. Inflation has surprised him, he says. “Further surprises could be in store,” he said.

Still, he made that today’s hike was likely not the last rate increase.

“There’s probably significant additional tightening in the pipeline,” he said.

Also Read | How does a Federal fund rate hike work?

The Federal Reserve accelerated its efforts to reverse its easy-money policies by approving another unusually hefty interest rate hike and warning that more hikes were likely to follow to battle inflation, which is at a 40-year high.

Also Read | How the US Fed rate hike will impact you?

Officials decided on Wednesday to raise their benchmark federal-funds rate by 0.75 percentage points, bringing it to a range of 2.25% to 2.5%. The 12-member rate-setting committee unanimously supported the rate hike.

Also Read | How to survive a market crash

Officials noted signs of slower economic activity since their last meeting in a policy statement issued following the completion of their two-day meeting. “Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months,” the statement said.

Also Read | US inflation rate at a 40-year high | A timeline: 1930-2022

“Today’s increase in the target range is the second 75 base point increase in as many meetings,” Powell said. “While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then” he said.

Also Read | Fed rate hike impact on crypto market

Powell said the Federal Reserve will make decisions moving forward meeting by meeting and it will communicate our thinking as clearly as possible.