The Federal Reserve began a high-risk attempt to contain the worst inflation since the early 1980s earlier this year, increasing its benchmark short-term interest rate and signalling further rate rises in the future.

The Fed’s interest rate hikes represent its effort to rein in soaring inflation that has accompanied the recovery. Many consumers and companies are facing higher borrowing rates as a result of the rate increases.

Also Read| How Paul Volcker tamed inflation with two recessions in 1980s

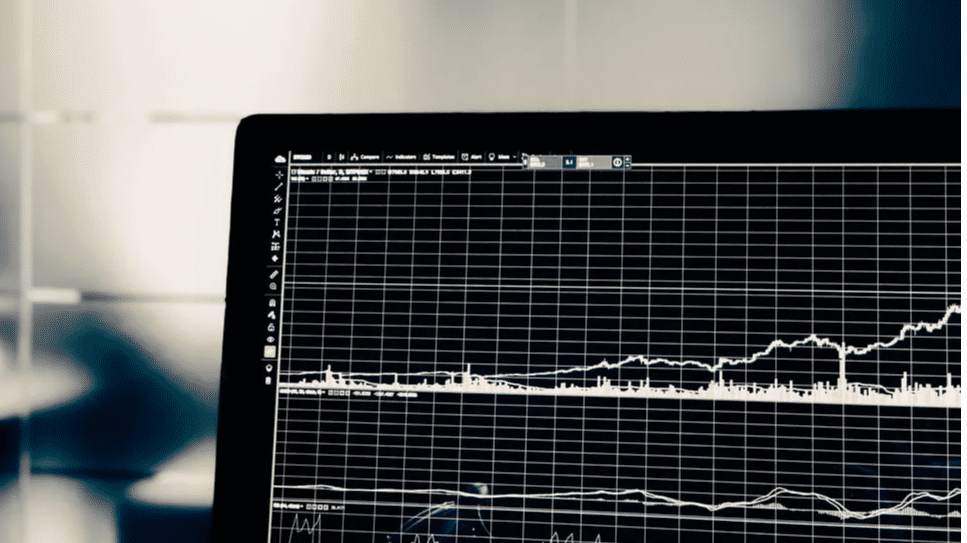

The Federal Reserve’s basic borrowing benchmark, the federal funds rate, has been below its historical average for the past 16 years. In reality, the Fed’s key rate was at 0% for nine of those years, first from 2008 to 2015, and again from March 2020 to March 2022. In the early 1980s, the Fed’s rate surged to a target level as high as 20%.

Also Read| Where to invest during high inflation?

Here’s a look at how the federal funds rate has varied throughout history:

1981-1990

The federal funds rate has never been higher than it was in the 1980s. The Fed aimed to battle inflation, which had reached its highest level on record in 1980: 14.6%. As a result, the Federal Reserve of the United States did something that may appear contradictory for an organization that seeks to maintain the most productive economy possible: it produced a recession in order to bring rates down. In January 1980, the federal funds rate was set at a target of 14%. By the end of a conference call on December 5, 1980, authorities had raised the target range by 2 percentage points to 19-20%, the highest level ever. Rates subsequently proceeded to decline dramatically, first to a target range of 13-14% on November 2, 1982, then to 11.5-12% on July 20, 1982. After some fluctuation, interest rates have not surpassed 10% since November 1984. During this 10-year period, the “effective” federal funds rate averaged 9.97%. Chairman Paul Volcker was the key mover of Fed policy throughout this decade, controlling the Fed until August 1987, when Alan Greenspan took over.

Also Read| How to survive a market crash

1991-2000

Greenspan had a considerably quieter time after the Fed’s chaotic few years of the Great Inflation, though that’s not to say he didn’t have his fair share of obstacles throughout his almost 18-year stint at the helm of the Fed. Following an eight-month recession that began in August 1990, Greenspan and the team were able to raise the federal funds rate to a target level of 6.5% in May 2000, the highest of the era. Rates fell to 3% in September 1992, the lowest level of the decade. Aside from the early 1990s, the Fed mostly revised rates during Federal Open Market Committee (FOMC) meetings, a practice that continues to this day. Officials did raise rates at an emergency meeting on April 19, 1994, in response to inflation fears, and they decreased borrowing costs in an unplanned meeting on October 15, 1998. Another notable achievement was the US central bank’s first “insurance” rate reduction, which meant authorities dropped interest rates to give the economy a boost rather than to battle a recession. Such was the situation in 1995, 1996, and 1998, when the financial sector faced a slew of challenges ranging from a Russian debt default to the collapse of a large hedge fund.

Also Read| Is it better to invest in real estate during surging inflation?

2001-2010

The 2000s were the Fed’s most rhythmic decade ever, with defined cycles for tightening and easing rates. After a stock market bubble in the technology sector broke, kicking off a recession that was aggravated by the 9/11 terrorist attacks, the Fed lowered interest rates 13 times to a low of 1%, a range that would have been unfathomable for those who remembered rates in the 1980s. The Federal Reserve of the United States then managed to raise interest rates 17 times between 2004 and 2006, all in quarter-point spikes, reaching a high of 5.25%. That was until the 2008 financial crisis and the subsequent Great Recession slammed the brakes on the economy. The Fed then did the unthinkable: it cut interest rates to near-zero levels by 100 basis points. Chairman Ben Bernanke led the Fed during this era, which was one of the most aggressive economic rescue initiatives in Fed history.

Also Read| Great Depression to COVID: Top 5 market crashes in American history

2011-2020

In the 2010s, the Fed couldn’t avoid zero interest rates any more than it could avoid severe recessions. Officials would eventually leave interest rates at rock-bottom levels until 2015, after which they would only raise interest rates by 25 basis points once each year. That is, until 2017, when the Fed raised rates three times, and again in 2018 when they raised rates four times. The federal funds rate reached a high of 2.25-2.5%. Faced with weak inflation and slowing growth, the Fed planned to drop interest rates three times in 2019 to give the economy a boost, akin to Greenspan’s “insurance” cuts in the 1990s. The federal funds rate appeared to be on its way to zero until the coronavirus pandemic struck, ushering in a new era of near-zero rates. As the economy ground to a standstill, the Fed reduced rates to zero in two emergency meetings held within 13 days of each other. In February 2014, Janet Yellen took over as Chair of the Federal Reserve from Bernanke and guided the economy through its Great Recession recovery until February 2018, when Chair Jerome Powell took over.

Also Read| The 2008 market crash: Inside the doomsday machine and a brief history

2021- Present

The Fed raised interest rates in September 2022 by three-quarters of a percentage point for the third consecutive time in a measure to cool down the high cost of living. The U.S. central bank has already increased interest rates four times this year. The central bank started hiking interest rates in the March of this year as the Covid-19 pandemic and the Russia-Ukraine war pushed the global economy into constantly surging inflation.