Evergrande, one of China’s biggest real estate developers, is struggling to avoid a default on tens of billions of dollars of debt, prompting fears of a possible wider shock wave for the financial system. With this news coming to the fore, the global stock market have been put on a high alert.

However, Chinese regulators have yet to say what they might do about the Evergrande Group. Experts are expecting Beijing to intervene if Evergrande and lenders can’t agree on how to handle its debts. But any official resolution is expected to involve losses for banks and bondholders.

Currently, Evergrande is the world’s most indebted real estate developer and is due to make interest payments of $84m (£61m) on its bonds on Thursday.

What is Evergrande about?

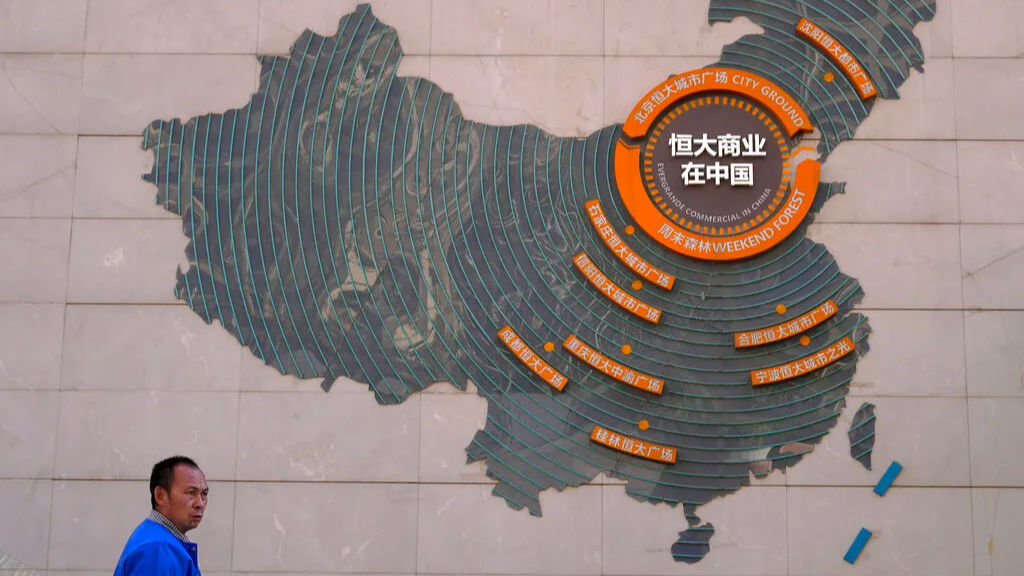

Evergrande was founded by businessman Hui Ka Yan in 1996 in Guangzhou, southern China. It was formerly known as the Hengda Group. Spread in 280 cities across China, the real estate group owns more than 1,300 projects.

The broader Evergrande Group deals in wealth management, making electric cars and food and drink manufacturing. It is also the owner of one of the country’s biggest football teams – Guangzhou FC.

As per Forbes, Hui Ka Yan has a personal fortune of around $10.6 billion.

Why is Evergrande at risk?

Over the years, Evergrande expanded aggressively and became one of China’s biggest companies by borrowing more than $300bn (£217bn). In 2020, Beijing laid down new rules to control the amount owed by big real estate developers.

The new rules meant that Evergrande had to offer its properties at major discounts so that the business could stay afloat with the influx of money. And now, it is grasping at straws to meet the interest payments on its debts.

This, in turn, saw Evergrande’s share price plummet by around 85% this year. The real estate’s bonds have also been downgraded by global credit rating agencies.

What happens if Evergrande collapses?

If Evergrande collapses, its ripples will be felt in a wider landscape.

Firstly, scores of people have bought Evergande properties even before building work began. Now, with the deposits already paid, they could lose the money if the company goes kaput.

Secondly, the firms that have their businesses with Evergrande are at the risk of incurring a huge amount of losses, forcing them into possible bankruptcy.

The third is the potential impact on China’s financial system.

“The financial fallout would be far-reaching. Evergrande reportedly owes money to around 171 domestic banks and 121 other financial firms,” the Economist Intelligence Unit’s (EIU) Mattie Bekink told the BBC.

Should Evergrande default, banks and other lenders may be forced to lend less. This could lead to a credit crunch (companies struggles to borrow money at affordable rates).

A credit crunch would be ominous news for China, keeping in mind that they won’t be able to borrow and will find it difficult to grow. This might even unnerve foreign investors.

Evergrande – ‘Too big to fail’?

As the risk of Evergrande collapsing seems true, experts are of the opinion that Beijing may step in and rescue it.

The EIU’s Mattie Bekink thinks so: “Rather than risk disrupting supply chains and enraging homeowners, we think the government will probably find a way to ensure Evergrande’s core business survives.”