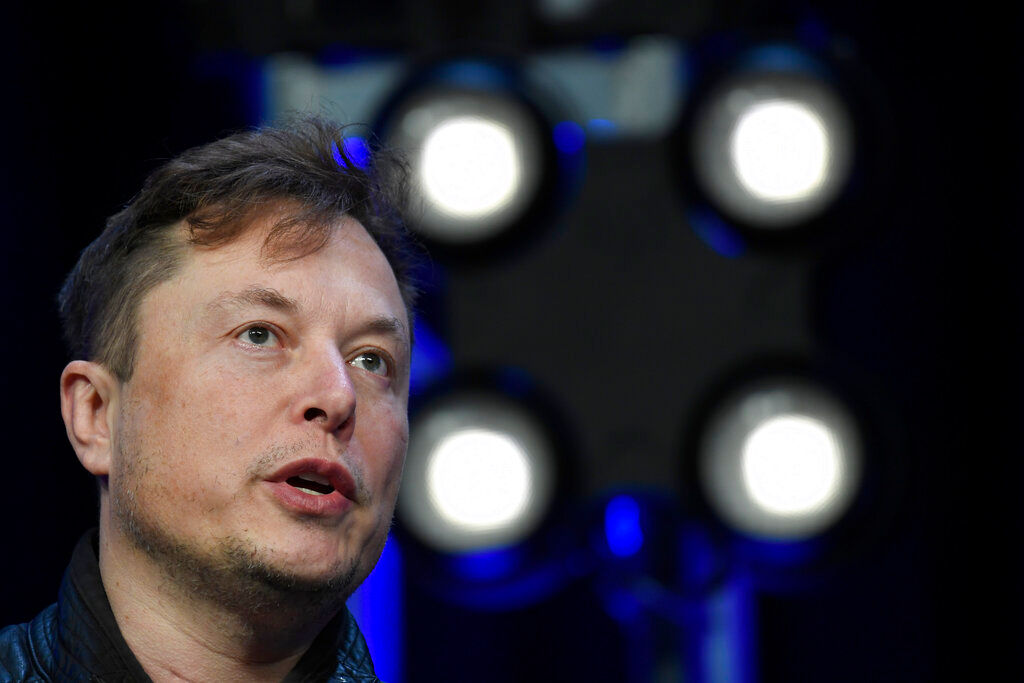

While Tesla CEO Elon Musk may have set out to terminate his acquisition deal with Twitter, the social media company appears to have a strong legal case, according to legal experts who spoke to Reuters.

Also Read: Twitter will sue Musk over completion of $44 billion merger and ‘prevail’

The Tesla CEO claimed that the social media company’s failure to disclose information bout bots it had on its platform had the potential to cause “Material Adverse Effect.” In the world of mergers and acquisitions, MAE can affect the value of a company.

However, a judge at the Delaware Court of Chancery in 2020 (which is well-known as a hub for arbitrarting cases between companies) stated that the term could be defined as consequential to a company’s long-term earnings over a “reasonable period” which are better measured in “years rather than months.” It is no surprise that legal experts believe that Twitter seems to have a better case than Musk.

Also Read: Elon Musk ends Twitter deal: How the company’s employees reacted to Tesla CEO’s pull-out

The burden of providing the proof lies with Musk. Not only will he have to prove that the number of bots that Twitter reported to him were inaccurate, but he will also have to prove that the company’s failure to do so will significantly impact its future earnings in the future.

It seems likely that instead of slugging it out over many months in a courtroom, Twitter might opt to renegotiate or settle instead. A law professor at UC Berkley, Adam Badawi told Reuters that the there was a likelihood that the social media platform would settle at a different price as “litigation is expensive.” He said that given the complexity of the deal, a long-running court case might not be “worth it.”

Even though Musk has pulled out from the deal, it seems unlikely that he will win. In the history of such deliberations in Delaware, only one clear-cut case of MAE emerged. In 2018, German healthcare company Fresenius Kabi pulled out from a merger with US-based drug makers Akorn Inc. It was found that Akorn had not met regulatory compliance targets, despite assuring Fresenius. Additionally, the US drugmakers had not disclosed their declining performance after numerous whistleblower allegations were made public.