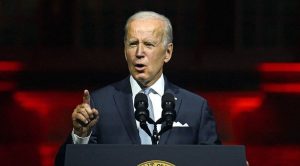

JPMorgan Chase has urged President-elect Joe Biden to support additional aid to people left jobless due to the COVID-19 pandemic as a way to address income inequality, AFP reported quoting a banking source.

In a list of recommendations to the President-elect’s team, the giant US bank said the coronavirus pandemic was “straining families’ economic mobility and restricting the US economy,” citing in particular the August expiration of extra $600 weekly payments from the government to the unemployed.

Recipients of that aid cut spending by 14% after their expiration that month, and the decline shows no sign of “having plateaued, suggesting that spending among the unemployed could likely decline further,” the bank said.

“While the unemployed roughly doubled their liquid savings over the four-month period between March and July 2020, they spent two thirds of accumulated savings in August alone.”

The report also urged policymakers to clarify that recipients of mortgage forbearance under the CARES Act stimulus package would not be required to make “balloon” payments at the end of the period.

The CARES Act provided small businesses with a now-expired program of loans and grants to keep them from closing amid the pandemic, and the bank calls for both another round of funding and changes for them to better align with the needs of Black- and Hispanic-owned enterprises.

The bank also threw its weight behind other measures to address long standing racial inequality, such as an expansion of programs on job training aid, enhanced federal support for affordable housing and the elimination of barriers to hiring formerly incarcerated people.