Liz Truss on Monday reversed her plan to cut the highest rate of income tax after mounting pressure from within the Tory party and turmoil in the UK’s financial markets, just weeks after taking over as the Prime Minister. The announcement from finance minister Kwasi Kwarteng while on air on BBC1’s Breakfast show.

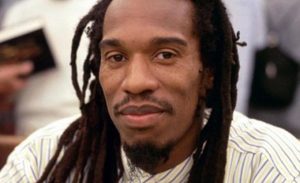

The career politician, along with Kwarteng announced a set of tax cuts on September 23 in a mini-budget. Many criticised the plan as being focused on incentivising the wealthy.

Kwarteng announced on Monday that one of the more contentious decisions in the new financial plan, which would cut tax for people making £150,000 or more had become a “distraction from our overriding mission to tackle the challenges facing our country.”

Speaking to the panel on BBC1’s Breakfast, Kwarteng said that the tax cut issue was drowning what was otherwise a ” strong package of intervention on energy, a strong package of intervention on tax cuts for people generally.”

At the time, the announcement sparked a crisis in investor confidence tanking the value of the pound and affecting the global market as people ditched government bonds. So much so that the Bank of England stepped in with a £ 65 billion programme in an attempt to stop markets from deteriorating. The move even drew a rarely seen remark from the International Monetary Fund.

The announcement comes as a surprise as Truss said last week in numerous interviews with BBC stations that her new plan would curb inflation by 5 percentage points. However, on Sunday she told the BBC that she could have “laid the ground better” for the proposed mini-budget, she was firm on seeing it through.

Monday’s U-turn is likely because of the realisation that MPs in Parliament who were against the proposed plan were unlikely vote in favour it.

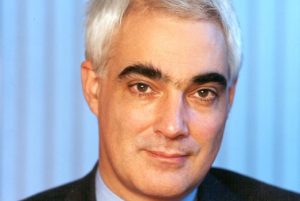

Meanwhile, opposition parties have used the rollback as an opportunity to hit back at the Tory government. Labour’s shadow chancellor told The Guardian that government had destroyed their “economic credibility” and “damaged trust in the British economy.”