Adani Wilmar, the group’s newest member, entered the club on Tuesday, a day after Adani Power’s market capitalisation surpassed Rs 1 trillion. Shares of the edible oil manufacturer have risen three-and-a-half-fold since its February listing. In doing so, the group has surpassed HDFC Group in market capitalisation.

Also Read| Gautam Adani joins rank of Elon Musk, Jeff Bezos in $100 billion club

Adani Group’s aggregate market capitalisation, according to Bloomberg statistics, increased by Rs 10 trillion in the previous year, to Rs 17.26 trillion, which is Rs 4 trillion higher than HDFC Group’s as of Tuesday’s closing. While Tata Group remains number one with a market capitalization of Rs 22.87 trillion, Mukesh Ambani Group enterprises are ranked second with a market capitalisation of Rs 19.16 trillion.

Also Read| Tesla’s valuation falls by $126 billion amid Elon Musk’s Twitter takeover

Furthermore, with Adani Wilmar’s newest achievement, Adani Group companies now dominate the top 50 companies by market capitalisation. The Tata group currently has four companies on the top 50 list, while Bajaj, Aditya Birla, and HDFC each have three.

Also Read| Trending Stocks: Bajaj Finance, HDFC Life, Wipro and others in news today

While increased power consumption as a result of rising temperatures and a post-Covid rebound has boosted power stocks, Indonesia’s prohibition on palm oil exports has boosted domestic edible oil producers’ outlook.

Also Read| LIC IPO: Price band fixed at Rs 902-949, Rs 60 discount for policyholders

On Tuesday, four of the Adani group’s seven companies achieved new all-time highs, with Adani Power and Wilmar touching their upper circuits during the trading. Furthermore, thus far in 2022, each of them has outperformed benchmarks with impressive returns. Adani Transmission has risen 63.2% since January, while Adani Power and Adani Green Energy have more than doubled. In comparison, Sensex fell 1.5% within the same time period.

Also Read| How India’s new crypto tax impacts investors

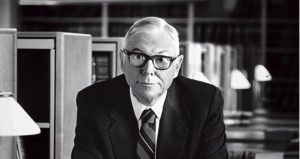

The rise in the stock prices of the group’s companies also boosted founder Gautam Adani’s fortune, propelling him above renowned investor Warren Buffett to become the world’s fifth-richest person. Gautam Adani’s net worth climbed to $123.7 billion as of Friday’s market close, according to Forbes calculations, while Warren Buffett’s net worth was $121.7 billion.