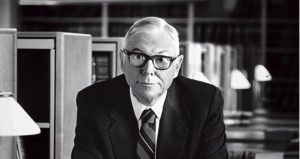

Warren Buffett, known as the ‘Oracle of Omaha’, is considered one of the most successful investors of all time. He runs Berkshire Hathaway, which owns more than 60 companies. Son of a US congressman Howard Homan Buffet from Nebraska, he first bought stock when he was 11-years-old and first filed taxes two years later, Forbes reported.

Born August 30, 1930, in Omaha, Nebraska, Buffett graduated from the University of Nebraska in 1950. After getting rejected from Harvard Business School, he completed his master’s in economics from Columbia University.

Also Read | Rakesh Jhunjhunwala net worth: Source of wealth explained

In 1956 he returned to Omaha but already had taken majority control of the textile manufacturer Berkshire Hathway in 1965.

From the 1960s through the ’90s the major stock averages climbed by roughly 11% annually, but Berkshire Hathaway’s publicly traded shares gained about 28%.

In June 2006, Buffett announced that he is planning to donate more than 80% of his wealth to a handful of charities, lion’s share of which was promised to the Bill and Melinda Gates Foundation.

Gates and Buffett maintained a close friendship since the early 1990s and in 2010 launched together the ‘Giving Pledge’, urging billionaires to donate at least half of their wealth to charitable causes.

During the mortgage crisis of 2007–08, Buffett made a number of deals that were criticised but proved to be highly profitable.

Also Read | Is it better to invest in real estate during surging inflation?

Between 1950 and 1956, Buffett consolidated his personal capital up to $140,000 from a mere $9,800.

In 2019, at Berkshire Hathaway’s annual shareholder meeting, it was hinted that Buffett would be succeeded by Greg Abel, CEO of Berkshire Hathaway Energy and Vice Chairman in charge of non-insurance operations. However, Buffett had confirmed that he has no plans to retire anytime in the near future.

Between 2008 and 2011, Buffett made deals with blue-chip companies as Mars, Goldman Sachs, and Dow Chemical.