Industry body Assocham has urged the

government to reduce the customs duty on copper concentrate to zero from 2.5%

to provide a level playing field to all stakeholders.

The move will help the

industry to compete with imports of value-added copper products from free trade

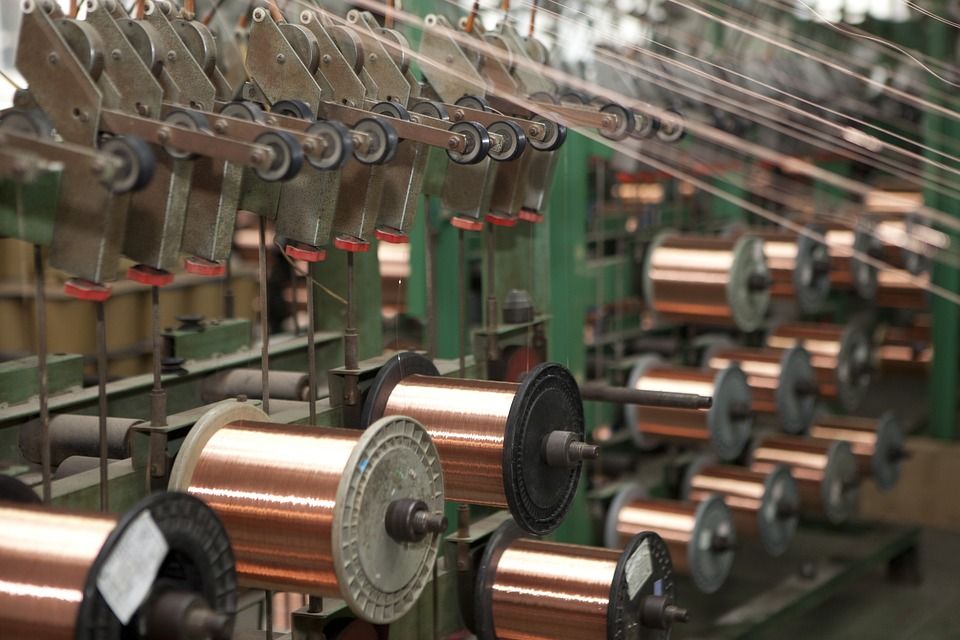

agreement (FTA) countries under zero duty. Copper concentrate is the basic raw

material used by the copper industry.

Also Read | Budget 2022: Why has the halwa ceremony been dropped this year?

Assocham in its pre-budget suggestions said,

due to the non-availability of copper concentrate in India, there is no

economic rationale to continue with import duty on copper concentrate. Bringing

down the customs duty will enable the industry to have a level playing and

compete with imports of value-added copper products from FTA countries under

nil duty.

The Indian copper

industry imports 95% of the copper concentrate due to its limited availability

in the country. The domestic availability is merely 5% of the total

consumption.

Also Read | Budget 2022: Steel Industry demands duty reduction, policy measures

Currently, 2.5% customs duty is charged on the

import of copper concentrate whereas refined copper is being imported

into India at zero duty under free trade agreements, which makes it a clear

case of an inverted duty structure.

Most Asian economies such as Japan, China,

Thailand and Malaysia do not have sufficient copper concentrate and these

countries allow its free import. The cost structure of smelters in those

countries is lower on account of zero import duty.

Also Read | Budget 2022: Travel agents’ body seeks ‘One India One Tourism’ approach

Export restrictions in supplier countries like

Indonesia, an FTA partner country of India, leave India with the limited option

to source from Chile, which has long-term commitments (up to 90% of

production) to countries like Japan and China, which have invested in copper

mines in these countries.

Unfortunately, apart from Chile and Indonesia,

most of the copper concentrate surplus countries are not covered by FTAs with

India.

Also Read | Budget 2022: Salaried class expects revision in tax slab, section 80C limit

Duty reduction will not impact the domestic

downstream industry because it is a starting point of the refined copper value

chain for the bulk of the industry. It will provide much-needed relief to the

industry, which is suffering from extremely adverse trends in its value

drivers.

Also Read | Budget 2022: Pharma industry expects tax consessions, higher healthcare allocation

The Indian refined copper industry needs all

the government support in sourcing its raw material and hence it makes immense

economic sense to exempt it from customs duty.