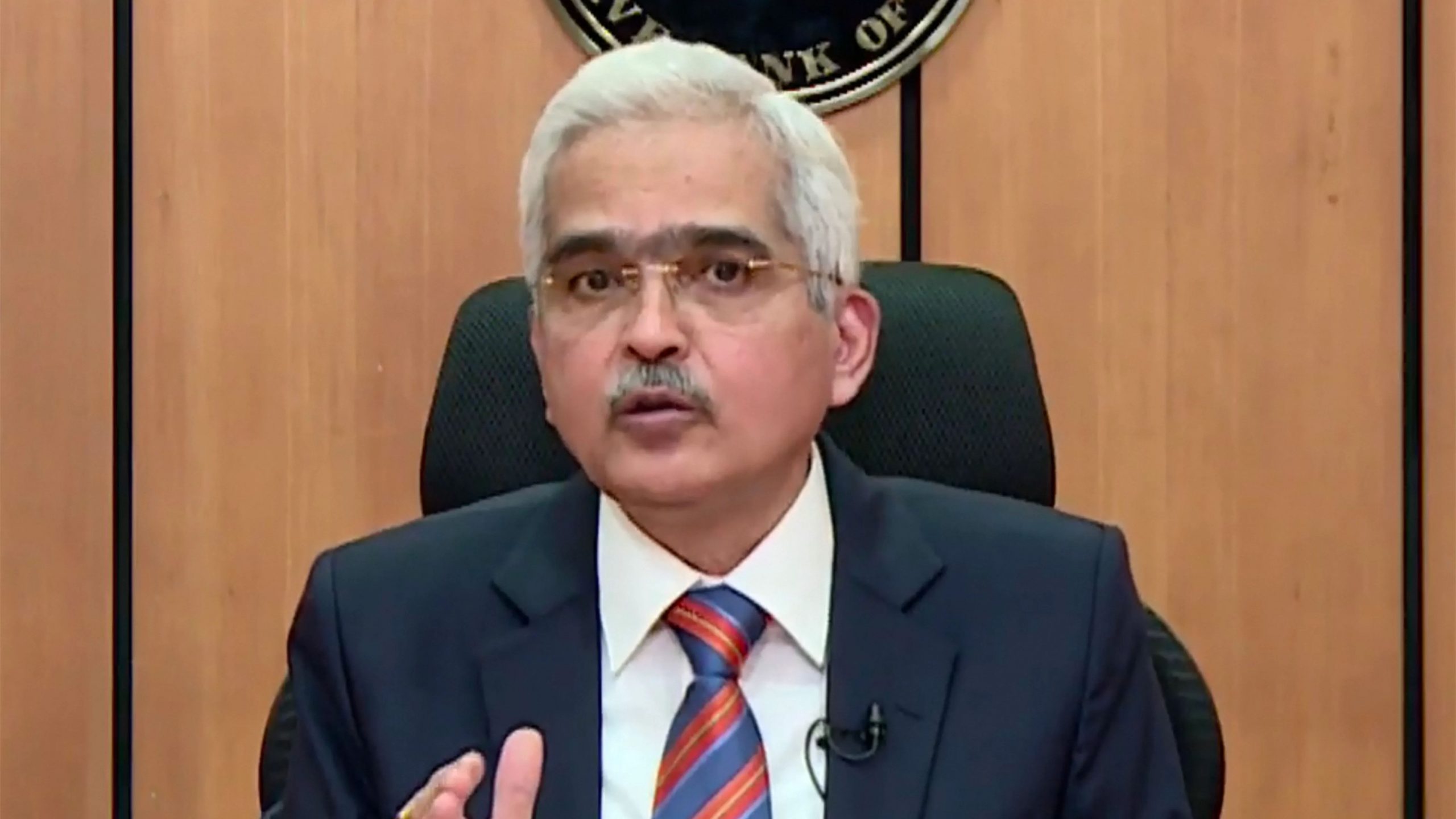

Reserve Bank of India Governor Shaktikanta Das on Wednesday announced Rs 50,000 crore priority lending by banks for hospitals, oxygen suppliers, vaccine importers, COVID drugs by March 31, 2022. His announcement came as he said banks will provide fresh support in the form of loans to businesses involved in manufacturing and importing vaccines and other healthcare supplies.

He was announcing a slew of measures to blunt the impact of the ongoing second wave of COVID-19 in the country.

Calibrated action is needed to fight the current surge of COVID-19, says Shaktikanta Das. He says that India is fighting a ferocious rise in coronavirus cases as he adds he has faith in India’s ability to come out of the current crisis.

“Reserve Bank of India will deploy all resources and instruments at its command especially for the citizens, business entities, and institutions beleaguered by the second wave,” Das says.

Das says the situation (in India) has reversed from being on the foothills of strong economic recovery to facing a fresh crisis while talking about the second wave of COVID-19 in the nation.

The RBI also KYC norms, directing banks not to impose any restriction till the end of December this year.

The announcement comes amid a devastating COVID-19 wave that has pummelled India in the recent weeks with daily case tally hovering around the 4-lakh mark and death toll over 3,000.

Experts have warned of the situation worsening in mid-May before it starts tapering. The industry, which had initially resisted any widespread lockdown as they thought it would hit businesses, has now demanded that it be imposed to stem the spread of the pandemic.

“The healthcare infrastructure and supply build-up are being undertaken on an emergency basis by the governments at the centre and states, but will take time. At this critical juncture when the toll of lives is rising, CII urges the strongest national steps including curtailing economic activity to reduce suffering,” CII president Uday Kotak said in a recent statement.

The RBI in its earlier announcements has announced fiscal support measures to help tide over the pandemic fallout, cutting interest rates and keeping monetary policy loose.