The Reserve Bank of India on Friday left key interest rates unchanged at 4% for the fourth time in a row while pegging the GDP growth for the next fiscal at 10.5%

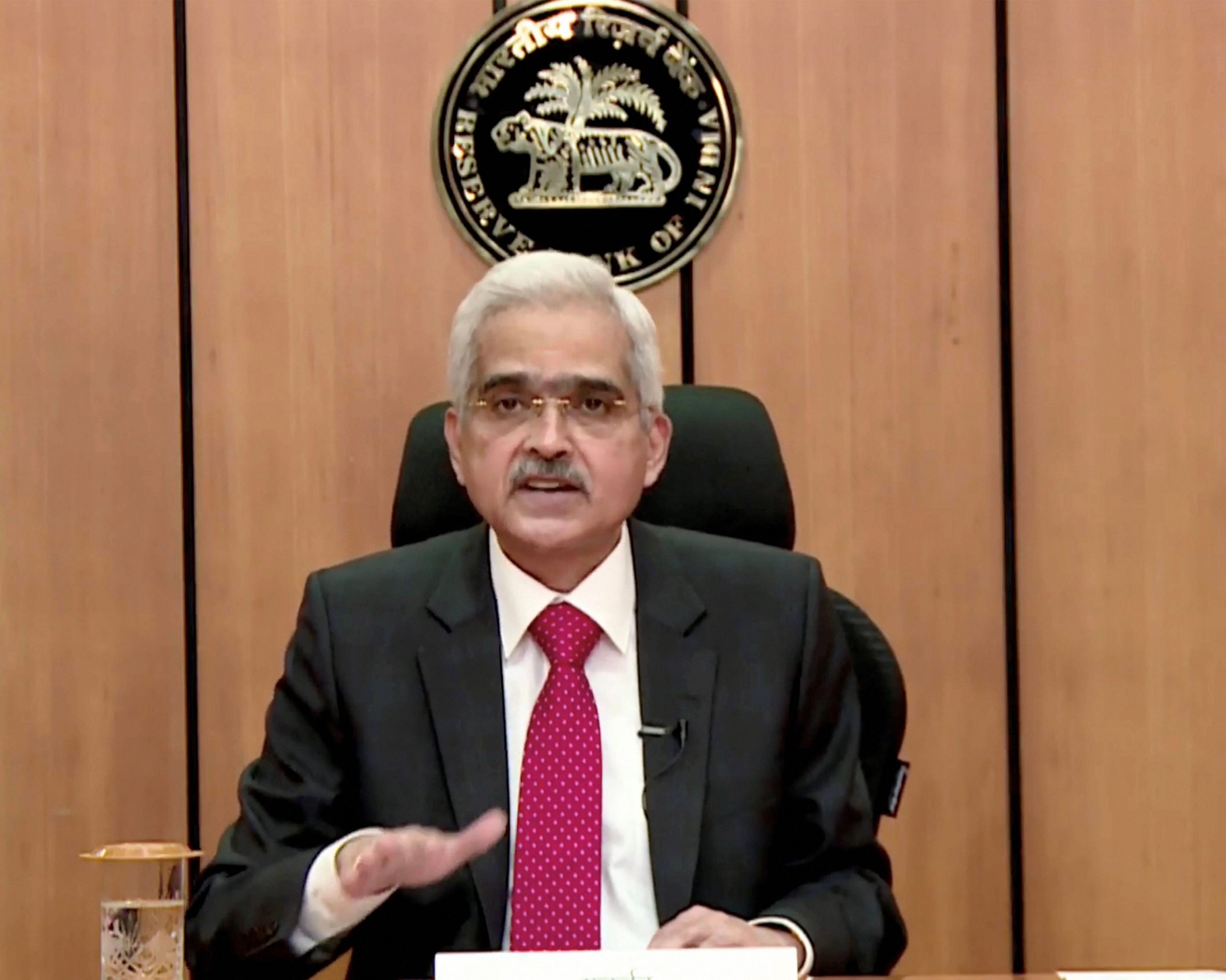

“The Monetary Policy Committee voted unanimously to leave policy repo rates unchanged at 4%,” RBI governor Shaktikanta Das said. This means the repo rate is maintained at 4% and reverse repo rate at 3.35 %.

(Read more: How change in repo rate affects EMI)

Das added that the Monetary Policy Committee (MPC) had also decided to continue with an accommodative stance as long as necessary “at least through the current financial year and into next year to revive growth on a durable basis and mitigate the impact of COVID-19.”

The announcement follows three days of discussions by the Monetary Policy Committee (MPC) and comes on the heels of the central government, earlier this week, unveiling massive borrowing plan. Most economists expected the MPC to continue holding the repurchase rate at 4%.

Last year, the MPC cut interest rates by 115 basis points to maintain liquidity in the financial system but has maintained the status quo for the last three meetings.