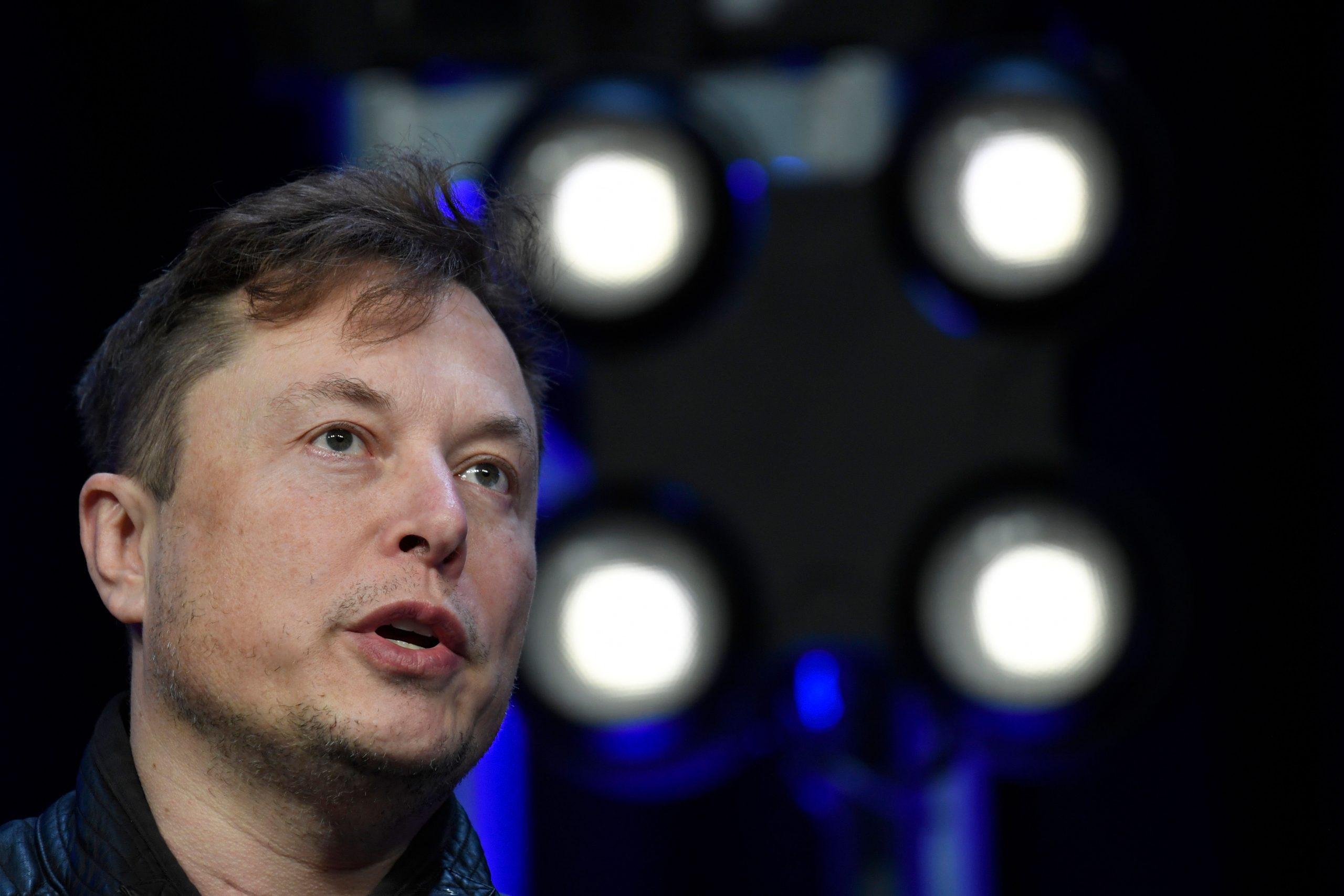

Elon Musk, one of

the world’s richest men, has been unrelenting in his pursuit of Twitter, one of

the world’s biggest social media networks. From attacking Twitter’s board, to

refusing a seat at the table, to vowing to buy a 100% stake, Musk has tried it

all. So much so, that Twitter had to swallow a poison pill to keep Musk at bay.

Having realised that his current pursuit isn’t yielding the desired result,

Musk seems to be trying a “tender” approach.

Tenderness has

been on Musk’s mind over the last few days. His tweets are lined with

references to Elvis Presley’s “Love Me Tender” and F. Scott Fitzgerald’s novel “Tender

Is the Night” whose title is taken from John Keats’ “Ode to a Nightingale” and he really is looking at the social media giant to fulfil some

of his dreams, if not all. For a man who seeks to colonise Mars, that’s not

little.

Also Read | Elon Musk confirms leaked texts on feud with Bill Gates over Tesla stock

Musk had initially

pledged $43 billion to acquire all of Twitter. But Twitter said it was

too little and swallowed a poison pill to stop anyone from acquiring over 15%

of the company. If Musk’s $54.20-a-share bid is rejected by Twitter’s board,

one of the options available to him would be going tender, and it is an option he has confirmed that he will exploring, according to a Wall

Street Journal report.

Also Read | Why Elon Musk wants to buy Twitter: Explained

Making a tender

offer is one of two ways to buy a publicly-traded company. While the easiest way

is to have a board-approved merger, another, the ‘tender’ way is to appeal

directly to shareholders to sell or tender their shares at a specific price.

This strategy is applied when a company’s board doesn’t want to engage.

Also Read | Elon Musk attempts to secure funding to buy Twitter: Report

And as opposed to

the board-approved strategy, a tender offer is often not an all-or-nothing game.

While the buyer may bid for all the shares, they may also go away with just

over 50% in order to obtain a controlling stake. When a tender offer seems to

be on the way to succeed, boards typically capitulate.

If Musk is to make

a tender offer to Twitter shareholders, he will have to announce the offer at a

specific price with some regulatory paperwork. The offer will have to be on the

table for 20 days and Twitter’s board will have 10 days to make its own

recommendation to the shareholders. If Musk doesn’t obtain the number of tenders

he wants, he may cancel or amend the offer.

Also Read | Why is Twitter swallowing a poison pill? To stop getting eaten up by Musk

However, one thing

that still stands between Musk and the tender approach is the poison pill. The

poison pill disallows a shareholder from owning over 15% stake and Musk already

owns nearly 9%. However, a successful tender offer would send a message to the Twitter

board, who will not want to miff shareholders, especially with the company’s

annual meeting scheduled for May 25.