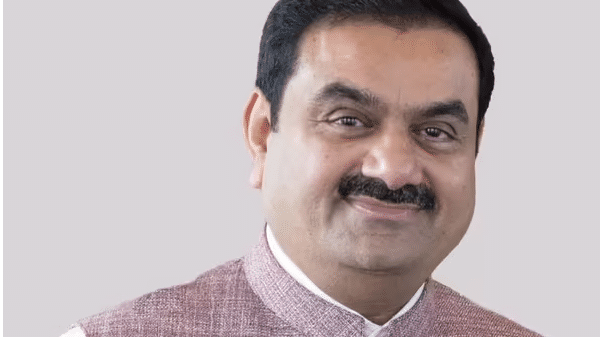

Gautam Adani is now the world’s third richest person with a net worth of $137 billion, according to Bloomberg Billionaires data. The 60-year-old billionaire follows Elon Musk and Jeff Bezos on the elite list.

He has surpassed Bill Gates and Bernard Arnault, the co-founder of LVMH Moet Hennessy Louis Vuitton.

Also Read| Adani Group says RRPR is obligated to transfer NDTV shares to VPCL

An Asian has never previously been among the top three wealthiest persons in the world, according to a Bloomberg report. Other wealthy Asians, such as Reliance Industries Limited‘s chairman Mukesh Ambani and China-based Alibaba Group’s Jack Ma, have not reached this level.

The Adani Group, India’s largest port operator, is co-founded by Gautam Adani. According to reports, the group is the country’s leading coal trader. Adani Enterprises recorded $5.3 billion in revenue for the fiscal year ending March 31, 2021, according to the Bloomberg profile of Asia’s richest person.

Also Read| Adani Group needs Sebi permission to secure stake in RRPR: NDTV

Five times over any other person, Adani increased his wealth in 2022 by $60.9 billion. He surpassed Ambani as the richest Asian in February and in July overtook Microsoft Corp.’s Bill Gates as the world’s fourth-richest person.

Adani has upped his philanthropic contributions too. In June, he committed to donate $7.7 billion to charitable initiatives on the occasion of his 60th birthday.

Also Read| Congress slams Adani’s NDTV hostile takeover

Adani Group made headlines last week when it announced that Vishvapradhan Commercial Private Limited (VCPL), the wholly owned subsidiary of Adani Enterprises Limited’s AMG Media Network Limited (AMNL) is set to purchase a 29% stake in New Delhi Television Limited (NDTV) and will make an open offer for 26% of the media firm’s shares. However, NDTV has stated that the transaction is subject to approval from market regulator SEBI.

The open offer for a 26% stake in NDTV has a value of Rs 493 crore, according to the papers provided to stock exchanges on Tuesday. The open offer price has been set at Rs 294 per share, a 37% decrease from Tuesday’s opening price of Rs 467.25 per share.

Also Read| NDTV shares surge 5% to 14-year high after Adani group acquires 29% stake

The open offer being way below the market price puts a doubt on the seriousness of Adani Group to increase its stake in NDTV above 50% as selling shares for nearly 40% less than the market price makes no sense for those wanting to gain by selling, especially those holding a higher number of shares.

Also Read| Adani Firms to buy 29.2% stake in NDTV, launch open offer for another 26%

This apart, Adani’s major business acquisitions include the purchase of Swiss firm Holcim’s cement business in India for $10.5 billion in May of this year, bidding in the 5G spectrum auction for the creation of “a private network to support its businesses and data centres,” and purchasing a 74% stake in Mumbai International Airport (MIAL) in September 2020.