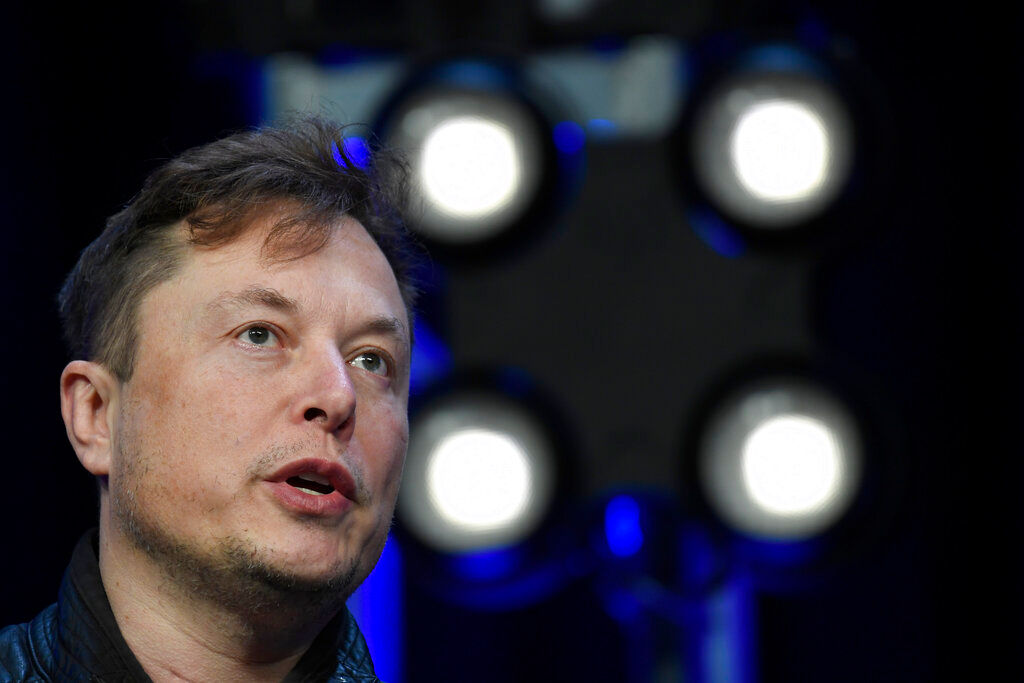

As the $44 billion Elon Musk-Twitter saga heads towards a close, its likely that the case will be immortalised as case study for students in business schools in the future.

Musk recently pulled a surprising U-turn by agreeing to buy Twitter at the agreed price of $54.20 per share, something that the billionaire has spent months trying to get out of. In fact, prior to agreeing to the set price, Musk looked for a 30% discount on the price. He later made a last attempt for a 10% cut to the price, which was also declined.

Also Read | What soon-to-be Twitter boss Musk thinks of Trump’s Truth Social

The case was scheduled to go to trial on October 17 over a period of five days. However the date has since been pushed back as Chancellor Kathaleen McCormick has given the two sides until October 28 to finalise the terms that will seal the deal.

Arturo Bris, Professor of Finance and Director of IMD World Competitiveness Center told Reuters that the case was “definitely a business school case study” because it was about “poison pills, breakup fees, lawsuits, hostility.”

In a message to Twitter CEO Parag Agarwal, Musk has written that he hated doing “mgmt [management] stuff”. This was just weeks prior to Twitter’s board agreeing to the $44 billion buyout. Musk had at the time said, “I kinda don’t think anyone should be the boss of anyone.”

That being said, with the deal with Twitter about to close, Musk is going to be expected to be at least partially hands-on about managing a company that has been beset by one crisis or the other.

However, it is possible that Musk might just go the way of WeChat and turn Twitter into an ‘everything app’, which could offer users a range of services and products ranging from banking to loans to bill payments and of course, instant messaging.”