Sri Lanka authorities announced on Tuesday that the country will default on all of its external debt as it deals with an economic crisis. The South Asian island nation’s external debt reportedly amounts to $51 billion.

Sri Lankan Finance Ministry while announcing the debt default gave creditors two options: Either opt for payback in Sri Lankan currency or capitalise on any interest payments due to them from Tuesday, AFP reported.

Also Read: Sri Lanka hikes interest rates by 700 basis points to tackle inflation amid economic crisis

Sri Lanka also seems to be reliant on a bailout from the International Monetary Fund while authorities work to streamline “essential imports.”

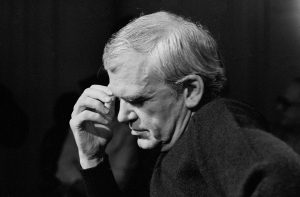

P. Nandalal Weerasinghe, the Governor of Sri Lanka’s central bank said in a statement, “We need to focus on essential imports and not have to worry about servicing external debt”, Economic Times reported.

Also Read: What is China’s debt-trap diplomacy: Communist ploy or West’s lie?

“This will be on a temporary basis until we come to an agreement with creditors and with the support of a programme with the IMF”, the central bank governor added. He took over as the central bank governor late last week as protests continued in Colombo.

The statement from Sri Lanka’s finance ministry on Tuesday said that the “government is taking the emergency measure only as a last resort in order to prevent further deterioration of the republic’s financial position.” The default was portrayed as a “fair and equitable treatment of all creditors”, AFP reported.

Also Read: US issues new advisory, asks citizens to ‘reconsider’ travel to Sri Lanka

For months, Sri Lankans have stood in long lines to buy fuel, cooking gas, food and medicines, most of which come from abroad and are paid for in hard currency. The fuel shortage has caused rolling power cuts lasting several hours a day.

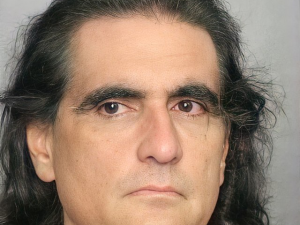

Much of the anger expressed by weeks of growing protests have been directed at the Rajapaksa family, which has been in power for most of the past two decades.